nj bait tax instructions

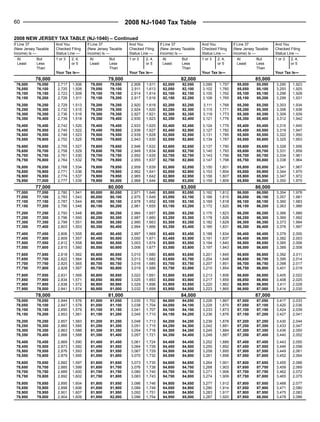

5675 for distributive proceeds below 250000. If the sum of each members.

Instructions for Completing the.

. Bracket Changes As a result of the amendments the BAIT increases to the. Pass-Through Business Alternative Income Tax Act. Along with payment must be filed online at njgovtaxation until 1159 pm.

However my understanding is that the NJ BAIT payment is deductible as a business expense of the PTE in my case an S-Corp. September 3 2021. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax.

The concerns of passthrough. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law. The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT.

The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year. PL2019 c320 enacted the Pass-Through Business.

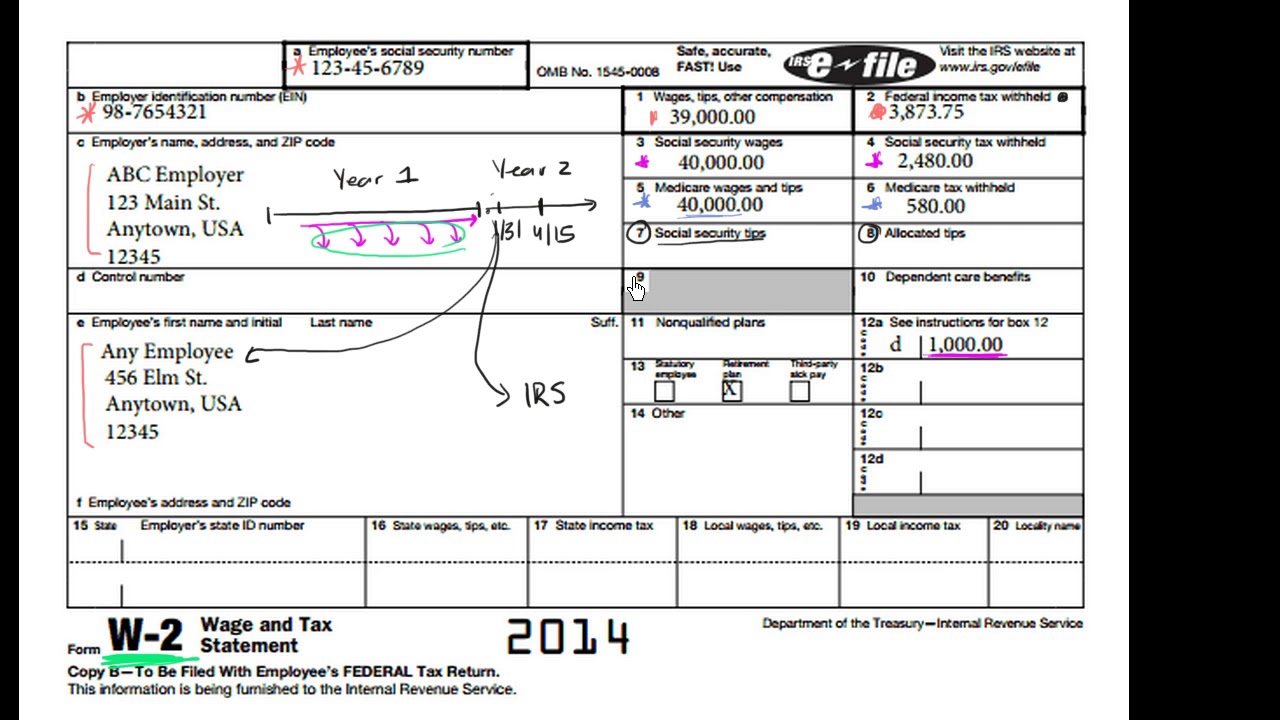

The BAIT for New Jersey S Corporations continues to be limited to New Jersey-sourced income. Pass-Through Business Alternative Income Tax PTEBAIT Pass. On January 13 2020 New Jersey Governor Phil Murphy signed the NJ SB3246 Pass-Through Business Alternative Income Tax Act into law.

Good News in New Jersey. This is an entity-level tax to work. Governor Phil Murphy Lt.

The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal. Pass-Through Business Alternative Income Tax Act. New Jersey Pass-Through Business Alternative Income Tax PTE Election.

In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT. However it is not reported on the 1120-S schedule. Instructions for Pass-Through Business Alternative Income Tax Application for Extension to File Form PTE-100.

This change does not affect TY 2020. Official Site of The State of New Jersey. To access the NJ.

New Jersey State Tax Updates Withum

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

Intro To The W 2 Video Tax Forms Khan Academy

New Jersey Pass Through Entity Tax Election Bkc Cpas Pc

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Form Nj 1040nr Fillable Non Resident Income Tax Return

Nj Bait Deduction On Form 1040

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Nj Tax Refunds Likely To Be On Time But Feds Warning Of Slowdowns Nj Spotlight News

Nj Bait Election Video Tutorial Youtube

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Business Activity Code For Taxes Fundsnet

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

Nj Bait Forms Have Been Released News Levine Jacobs Co

New Jersey Business Alternative Income Tax Nj Bait Tax Knowledge Hub

New Jersey Clarifies New Net Operating Loss Rules Grant Thornton